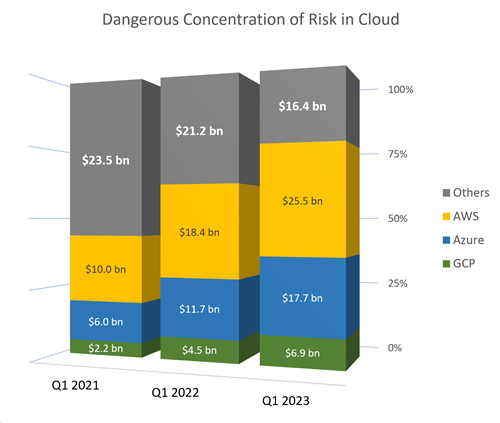

The latest estimates show that the world market for Cloud infrastructure has grown by almost 20% in the last year, to $66.5bn in Q1 2023, and that’s 60% higher than two years ago. AWS is very much the leader with its Cloud revenues estimated at well over $25bn. All the leading hyperscalers have grown significantly in the last two years: AWS up x2.5, Azure up x3 and GCP up x3.2.

The latest estimates show that the world market for Cloud infrastructure has grown by almost 20% in the last year, to $66.5bn in Q1 2023, and that’s 60% higher than two years ago. AWS is very much the leader with its Cloud revenues estimated at well over $25bn. All the leading hyperscalers have grown significantly in the last two years: AWS up x2.5, Azure up x3 and GCP up x3.2.

AWS is a juggernaught. It is huge, with a third of the total market, but its year-on-year growth has halved from 37% to 16%. Azure has done a little bit better in relative terms, with growth of 27% versus 46% a year ago. More significantly, AWS is now only 44% ahead of Azure whereas it was leading by 67% in Q1 2022. Google Cloud is making a valiant effort, growing by 30% in the last twelve months, but it is tiny and has just 8% of the available revenues.

Worrying implications

Behind these headlines, though, are some worrying implications. The three leading providers now take over 75% of the market between them. Looked at the other way around, the alternatives for customers have less than 25% of the market. Worse, the actual revenues flowing to the alternatives are shrinking in real terms, down to $16.4bn from $23.5bn two years ago.

So there is a hefty and increasing concentration of risk for businesses to factor in when deciding how to structure their dependency on Cloud.

Market concentration can lead to higher prices, weaker and less effective competition, and decreased choice for buyers. It can also lead to higher barriers to entry for competitors, which further reduces competition and economic efficiency. Crucially, the dominant firms have immense power over customers and politically, with increased risk of collusion and other anti-competitive practices. The three leading providers have a huge grip: the leaders are growing and the alternatives are shrinking, so the position will get worse unless something dramatic happens.

Buyers need to be mindful of these implications and factor the obvious conclusions into their decision making:

Prices are unlikely to be keen from any one provider. Put simply, neither of the two front-runners needs to compete on price – they’re just too dominant. However, they are likely to exploit gaps and differentiators that exist between them. In essence, they will compete with one another. An example is the way that Microsoft leverages its pentration in business software by offering cross licensing discounts with Azure. Customers can take advantage of price differences by being astute in what services they put where: Multi-Cloud not Solo Cloud.

Providers will do all they can to make it hard to go elsewhere. Competition is all about keeping the customers you’ve won, as well as winning new ones. So there’s less choice when buying for the first time, and these hyperscalers will do all they can to prevent you leaving. Their dominance means that they can. Two techniques, in particular, become traps: they entice customers with extra services but these are proprietary and make it much harder to go elsewhere; data is often free to upload and store, but there are hefty penalties for getting it back. Again, wise customers can choose how best to design their infrastruture to avoid these constraints.

System risks are concentrated, too. Recent studies have been focusing on the risks of outages, cross hacking, and other dangers that come from the unuually large concentration of dependency on, essentially, two providers: AWS and Azure. This February blog, by a technical architect from Oracle, detailed the three major Cloud outages that had happened in just the first few weeks of the year, one to each of the major hyperscalers. In each case, human error in technical configuration was to blame and the impact was vast. Once again, Cloud customers can use multi-cloud techniques to reduce their vulnerability.

The future is going to get bumpy. Governments and major institutions around the world are digging into the dominance of Big Tech and the behaviour of the major players. The big difficulty for Cloud customers is that regulatory actions and efforts are fragmented and uncoordinated. We know that changes will happen and regulations will start to alter the behaviour of Cloud providers, but what those are and when, and what the reactions of vendors will be is unknown. The Milken Institute provides a valuable tracker of regulatory efforts in the US, Europe and China, and it includes monthly digests of the major events. Cloud customers need to be agile and anticipate this rolling uncertainty when designing their infrastructure.

Conclusions for firms relying on Cloud

Going with big Cloud vendor and hoping for the best, compounds the risk to firms’ freedom to operate. The earlier that decision makers factor in the risks and uncertainties to their business strategy for Cloud, the better. These are business decisions for the C-Suite to take, not technology matters.

A wise strategy is to assume that problems will happen, and that business flexibility and choice should be major influences on decision-making about the approach to operating in Cloud. Avoiding having one single supplier for everything is an important underpinning to this strategy. Secondly, firms should be agnostic about the providers used, deploying individual services within your architecture with whichever provider makes most sense from a business perspective. Surprising price advantages can be unlocked by this, as well as independence. Lastly, be circumspect about using proprietary services from any provider, since these can tie your hands in the future. Moving to Multi-Cloud can be difficult, and there are many reasons for this, but they can be overcome with the right help and advice.

Going Cloud Agnostic

The huge scale and complexity of Cloud brands means that operational support is often too big for dev teams to take on, especially when unfamiliar Clouds are needed.

Whatever your starting point, Cloud support firms like Flexiion who are independent of any one vendor, give the advice and do the practical work needed for a Cloud Agnostic strategy. They will have teams of specialists in all the major Cloud brands and technologies and are familiar with systems in one Cloud or many. These independent firms bring a full range of operational experience and advice without a bias towards any one Cloud provider. They focus on what works well for the customer, and what doesn’t.

Independent and experienced specialists have much to contribute. They bring the extra skills needed, and work alongside the internal team to devise and deliver the future.

Peter is chairman of Flexiion and has a number of other business interests. (c) 2023, Peter Osborn