Last Updated on

Gartner’s much vaunted Hype Cycle decribes the journey from unreasonable expectations, through the inevitable trough as the fantasy bubble bursts. We’ve all seen it but usually with individual ideas, gadgets, technologies, whatever.

Gartner’s much vaunted Hype Cycle decribes the journey from unreasonable expectations, through the inevitable trough as the fantasy bubble bursts. We’ve all seen it but usually with individual ideas, gadgets, technologies, whatever.

Several waves of change seem to be heading our way at the same time, and it looks to me as though decision makers have some decisions to make.

Pointless scale has been rumbled

I’m not sure that Adam Neumann saw it coming. Either way the events were damning. It wasn’t many weeks between WeWork strutting round touting a $47bn IPO, and SoftBank stopping it lurching over the cliff by committing $10bn to take a total of 80% of the business, more than doubling its investment to $19bn, at a valuation of $8bn. Tell that to your investment committee.

I’m not sure that Adam Neumann saw it coming. Either way the events were damning. It wasn’t many weeks between WeWork strutting round touting a $47bn IPO, and SoftBank stopping it lurching over the cliff by committing $10bn to take a total of 80% of the business, more than doubling its investment to $19bn, at a valuation of $8bn. Tell that to your investment committee.

That was September, but the writing was on the wall in the summer when the wheels came off several large tech stocks. Investors’ signalled then that their willingness to believe was finally at an end: Uber, Lyft, Slack, Zoom.

No more buying growth at any cost, and hang the business model. Paying people to buy things from you is not a sustainable business model. It couldn’t go on indefinitely, and it looks as though it we’ve arrived at the moment of truth.

No more buying growth at any cost, and hang the business model. Paying people to buy things from you is not a sustainable business model. It couldn’t go on indefinitely, and it looks as though it we’ve arrived at the moment of truth.

If you want more on this, then look no further than Joshua Oliver’s great blog “Tech investors are subsidising my millennial habits“. He says that Uber Eats latest quarter posted an adjusted $316m loss on revenues of $645m, and thanked the Make Believe Start-ups for helping towards his cost of living.

Subscriptions are looking shakey

Consumers started to show signs of subscription fatigue last year: Netflix US subscriber numbers declined in Q2 and Q3, leaving them chasing gowth in International markets at significantly lower productivity. Try asking around to see whether people like subscriptions – it doesn’t need much digging to uncover latent resentment.

Consumers started to show signs of subscription fatigue last year: Netflix US subscriber numbers declined in Q2 and Q3, leaving them chasing gowth in International markets at significantly lower productivity. Try asking around to see whether people like subscriptions – it doesn’t need much digging to uncover latent resentment.

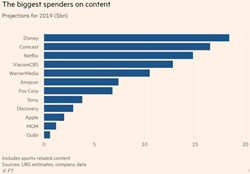

Yet look at the wall of money going into streaming, and still they come. Meg Ryan and Jeffrey Katzenburg are now jumping in with their “new concept” Quibi, and it’s yet another subscription business with fat funding.

It’s hard to see subscriptions being a reliable strategy for the long term, especially with pay-for-use becoming commonplace, like this pay-as-you-fly drone insurance. The proliferation of alternatives and easy options undermines fixed commitments like subscriptions, and encourages a pick-n-mix culture.

Monogamy is over

The increasing resistance to subscriptions is part of a wider trend away from monogamy. Consumers are valuing flexibility and free choice. This is being driven by the growing variety of options and alternatives, free trials and sign-up, and the growing liking for convenience and freedom of choice.

The increasing resistance to subscriptions is part of a wider trend away from monogamy. Consumers are valuing flexibility and free choice. This is being driven by the growing variety of options and alternatives, free trials and sign-up, and the growing liking for convenience and freedom of choice.

Jemima Kelly writes about some recent research that describes how Fintech is not turning out in the way envisaged by all those investment slide decks. Her graphic shows insurgents and traditional banks plotted by degree of exclusive use and scale and the market is splitting in two: consumers who remain loyal to the big incumbents, and the rest who use all sorts of things together.

Switching isn’t happenning but promiscuity is. Just watch people on their smartphones – text, Whatsapp, email perhaps, facebook, Instagram, Pinterest, Snap… On and on. Long gone is the world when there was just one thing that was used by everyone. I hear that the average business traveller in the US carries airline six loyalty cards – some loyalty.

Promiscuity is catching on in business

Business customers are starting to behave like consumers, too, and are assembling exactly what they need by combining services from different providers. The sophistication available in managed services now, means that you can select the best components from wherever they come from, and get an integrated and pragmatic infrastructure delivered as a managed service. Data at rest in some servers here; burst some of the peaks to AWS over there; a specialist AI service from Google with a TPU here. The days are gone when “oh, I put everything in AWS”.

Entrepreneurs are in there as well, assembling propositions from component services available through APIs. They get to an MVP faster, and means they’re flexible, too. Who has a USP now? This has all sorts of implications for risk and value, as well as privacy, data security, hidden vulnerability and scaling issues. This promiscuity breeds quite a new class of vendor, with new things for customers, investors and acquirers to get to grips with.

Physics is calling time

Moore’s Law is coming to an end; physics has shrunk electronics about as small as it can get, so the free ride of dependable performance improvement isn’t dependable any longer. There are some fancy hardware accelerators these days but they’re getting more and more application specific. Aside from these, improved performance is going to have to come from more efficient software, which is a whole new world.

Moore’s Law is coming to an end; physics has shrunk electronics about as small as it can get, so the free ride of dependable performance improvement isn’t dependable any longer. There are some fancy hardware accelerators these days but they’re getting more and more application specific. Aside from these, improved performance is going to have to come from more efficient software, which is a whole new world.

Physics also dictates how long it takes for signals to travel through networks and get processed. That latency hasn’t mattered to anyone besides high frequency traders in financial markets where machines transact with one another. Autonomous devices and IoT are coming over the horizon and latency really matters, now.

The old centralised Cloud model won’t work any longer, because Physics requires us to move compute and store out to the edge, near to the machines needing the low latency. Networks are changing to be software defined because if the machine moves, so must the compute and store that’s servicing it.

Systems architectures will have to be restructured. This is a very different world, and it’s just coming over the horizon. It’s visible today as 5G and IoT and autonomous vehicles will make it happen because they won’t work without it.

China is coming with no legacy, a vast home market, and new ideas

Almost two years ago, China reported that over 580m people there were using mobile payments. A staggering $17tn was paid using mobile in 2017. America, in contrast, is far behind. Is this because Western entrepreneurs and investors have been captivated by delivering familiar services at lower cost, while China has reinvented the whole thing? Perhaps the Asian advantage is that they have far less legacy to improve, and can adopt new models from day one.

America used to be the biggest, fastest growing market for adopting new products, services and technologies, but China and wider Asia far surpasses the US, now. This gives Chinese companies the advantage today, that American companies used to have – they can prove themselves and get established and very big at home, and then attack International markets with strength behind them. Just look at Huawei as an example.

The easy AI wins are in the past, now it gets harder

Artificial intelligence has come a long way since its beginnings half a century ago. In the WestiIt’s being used extensively to do more efficiently what we do already. We interact with AI in chatbots; many industries – not just airlines – are already incorporating automated and intelligent maintenance systems and other connected services into their business models. There’s a lot going on but tensions are building. A very sharp turning point came in 2012 when models became a lot more sophisticated and required much more power to train. Data sets are getting harder to assemble and manage. Speculation is growing that a new AI Winter lies ahead.

Artificial intelligence has come a long way since its beginnings half a century ago. In the WestiIt’s being used extensively to do more efficiently what we do already. We interact with AI in chatbots; many industries – not just airlines – are already incorporating automated and intelligent maintenance systems and other connected services into their business models. There’s a lot going on but tensions are building. A very sharp turning point came in 2012 when models became a lot more sophisticated and required much more power to train. Data sets are getting harder to assemble and manage. Speculation is growing that a new AI Winter lies ahead.

The early wins are behind us, and the headwinds are building once again. Tactical implementation on spot applications and to address particular opportunities only get us so far. Enterprises need to start thinking about different business models to avoid the limitations of simply automating humans out of existing and familiar processes. New techniques are needed to bring deep learning forward and deploy it effectively and efficiently.

Uncharted waters lie ahead

The last decade looks rather like a headlong, cash fuelled dash. The decade ahead looks more challenging with several fundamental questions that must be answered, and past assumptions under threat.

- Monogamy is over:

- Buying pointless scale is unsustainable and has failed as a strategy

- Fintech has failed to win the undivided attention of its customers

- The subscription business model is losing traction

- Everyone wants convenience, pragmatism, choice and flexibility, and are rejecting lock-in

- Consumers are already in a world of promiscuity

- Business customers are starting to act like consumers

- Entrepreneurs are assembling businesses from third party services, complicating ownership and risk

- We must find ways around the limits of Physics

- Moore’s Law can’t be depended on for future performance improvements

- The centralised Cloud model is incompatible with edge networks, IoT and autonomous devices

- Artificial intelligence is facing an eye-of-the-needle moment

- China is coming over the horizon and is in rude health

| First Page | Previous Page | Advisory |

|

|

|

Blogs on: Strategy, Trends, Management

Peter is chairman of Flexiion and has a number of other business interests. (c) 2019, Peter Osborn