Public Cloud services are widely available, and more and more firms are using these as a platform for their own technology services and systems. Tech teams, though, tend to have a favourite brand of Cloud, often out of familiarity or practicality. This can be a problem because there are several good, business reasons why firms might need to think differently:

- Responding to a new customer or opportunity

- Needing something not provided by their main supplier

- Unfavourable prices or a discontinued service

- Independence for redundancy and resilience

Are Cloud brands too big to understand?

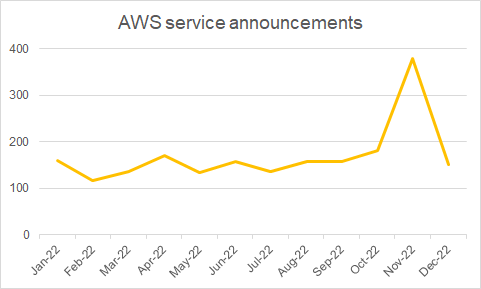

The major Cloud providers have raced to add more and more services to keep up with each another. AWS posts around 170 service announcements a month and November saw a big spike up to 380.

The major Cloud providers have raced to add more and more services to keep up with each another. AWS posts around 170 service announcements a month and November saw a big spike up to 380.

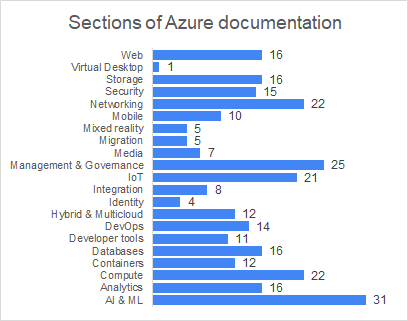

Microsoft Azure’s mind boggling documentation library is organised into 21 major sections. The section on AI & Machine Learning, alone, has 31 different categories, the first of those categories, by itself, is divided into 9 sub-categories with 19 links, the last of which is “more documents“.

Staying on top of that lot is a relentless workload for anyone who tries keep current, and this points to a much bigger problem: Public Cloud brands now have such a huge range and complexity of services that almost all teams struggle to understand everything that’s available.

Practicality forces monogamy

If the scale and complexity of services means it hard to know and understand what one brand offers, it is out of reach for most teams to attempt to know more than one. So teams tend to be comfortable with their favourite brand and are reluctant to consider others. Bias gets embedded.

If the scale and complexity of services means it hard to know and understand what one brand offers, it is out of reach for most teams to attempt to know more than one. So teams tend to be comfortable with their favourite brand and are reluctant to consider others. Bias gets embedded.

Bain research found that 71% of companies standardise on one provider’s public cloud, even though two-thirds say they would like to use more than one. The others may use more than one but say they spend an average 95% of their cloud budget with just one cloud service provider.

So practicality and familiarity leads to unwitting brand loyalty, and the business becomes locked in to that brand by default.

Of course this suits the Cloud providers who’re all competing in a tight market. Cloud use is continuing to grow but much of that is from existing customers extending what they do. The Cloud market is maturing. The leading brands can’t afford to lose business to their competitors, so they’re hardly likely to make it easy.

Good business reasons may call for a second Cloud

However hard it might be, business issues often call for a second Cloud provider alongside. Sometimes, there are urgent imperatives like meeting a customer request or addressing a new opportunity. It can be because a provider has withdrawn an important service, or simply that the usual brand doesn’t have the service or capability the business needs. Pricing changes are becoming commonplace, too, and increasingly problematic.

Of course, it could also be that adding a second provider is a valuable strategic move to avoid getting boxed in and to bring redundancy and resilience as well as risk reduction.

Will Public Cloud get any more friendly in the future?

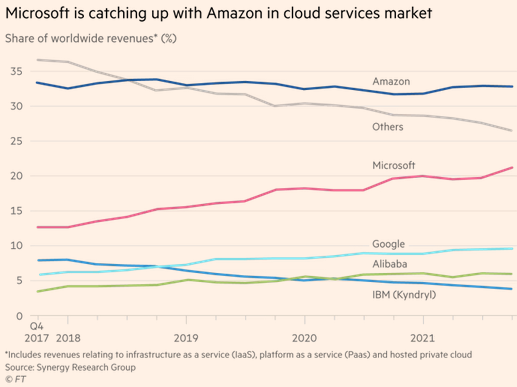

The Cloud sector is entering a new phase – it’s maturin g. The two leading players – AWS and Azure – now own more than half the revenues in the market. These leading brands are far ahead of the rest: Google Cloud has managed to climb only as far as 10%, and Alibaba has around 7%. So the top four divide up 70% of the market between them.

g. The two leading players – AWS and Azure – now own more than half the revenues in the market. These leading brands are far ahead of the rest: Google Cloud has managed to climb only as far as 10%, and Alibaba has around 7%. So the top four divide up 70% of the market between them.

There is little incentive for brands to concede space to their rivals or make it easy for others to win business, and powerful motives to keep customers inside their walled gardens.

There are some early signs emerging that brands are starting to shape and rationalise their services in response to this maturing market and their aging technologies. Some are beginning to retire services, which will present a particularly difficult and urgent challenge for those that use them. Pricing, too, is being adjusted.

- The Announcement of Discontinuing Google Cloud IoT Core Service Stirs Customers

- Amazon Web Services is getting ready to retire one of its oldest cloud computing services

- Amazon scrutinises lossmaking units in search of savings

- Google’s Stadia Shutdown Has Caught Stadia Developers Totally Off Guard

This all presents an important backdrop for business decision makers as they grapple with their business plans and work out how best to respond to the issues they face. This is especially testing in firms where the tech team is already stretched with deadlines and workloads that can’t easily be set aside or deferred.

How to get going with a different Cloud brand

Tech teams are almost always near to capacity already, with little in reserve to divert to learning a new brand, its service structures and technologies. So the challenge is always how to find the new technical skills, capabilities and bandwidth required to add a new Cloud into the mix.

Most support firms are specilists in one brand and often re-sellers of that Cloud provider, too. This sets up tensions because they would rather shift customers across to their favoured brand lock-stock-and-barrel, where they are more comfortable and can maximise their business. These firms rarely have experience of operating multiple clouds together.

Most support firms are specilists in one brand and often re-sellers of that Cloud provider, too. This sets up tensions because they would rather shift customers across to their favoured brand lock-stock-and-barrel, where they are more comfortable and can maximise their business. These firms rarely have experience of operating multiple clouds together.

Flexiion is one of a new type of operational support firm who are Cloud independent. They have teams of specialists in all the major Cloud brands and technologies who are used to working together on systems in one Cloud or many.

These independent firms bring a full range of operational experience and advice without a bias towards any one Cloud. They focus on what works well for the customer, and what doesn’t.

The huge scale and complexity of Cloud brands means that operational support is often too big for dev teams to take on, especially when unfamiliar Clouds are needed. Independent and experienced specialists have much to contribute. They bring the extra skills needed, and work alongside the internal team to devise and deliver the future.

Blog: Why operational people dominate the new Cloud era

Support for your Cloud – one or many

- Cloud support for stretched tech teams

- Support for a Cloud that’s unfamiliar

- DevOps, CloudOps, CloudSecOps

- More flexibility and scalability, less payroll

Peter is chairman of Flexiion and has a number of other business interests. (c) 2022, Peter Osborn