How the world has changed in such a short space of time. Just three years ago, Trump was in the White House, Jeremy Corbin was almost in Downing Street, and Get Brexit Done was everywhere in the UK media. It’s hard to think of a major business assumption that hasn’t been turned upside down since those far off days.

How the world has changed in such a short space of time. Just three years ago, Trump was in the White House, Jeremy Corbin was almost in Downing Street, and Get Brexit Done was everywhere in the UK media. It’s hard to think of a major business assumption that hasn’t been turned upside down since those far off days.

The financial environment is very different, with fundamental shifts in interest rates, foreign exchange, inflation, investor attitudes and focus. All these prominent drivers underpinning decision makers’ assumptions and business plans are now heading in quite unfamiliar directions.

The Pandemic hit, then dominated pretty much everything, and has since faded into the background in much of the world. The impact on business came like an avalanche. Many things in business changed, some have changed again, some have gone backwards, and we don’t yet know where it will all settle out.

People in and around business and as consumers have changed. In the UK, Brexit caused many Europeans to depart leaving permanent holes in the workforce and community. So called Quiet Quitting points to a different attitude towards work and careers, and the changes of working practices during the Pandemic have shifted the power of choice in the direction of staff and caused firms to pose fundamental questions about how they operate. Consumers are shifting attitudes, too, and the High Street has a crisis of identity.

Geopolitics has sharpened, with autocrats and populists causing fractures and shifts, and suggesting plausible doom laden scenarios we might have to respond to. Right now we have to deal with a wounded and dangerous man in Moscow and the havoc that has caused to the costs and complications of doing business, but others are on the horizon: Trump, Xi, Mr. Kim, Bolsonaro, Georgia Meloni, Climate Change; all yet more turmoil with no certainty as to where they will end up.

In the tech world, Digital Everything is here for almost everyone, although my friend who’s a tree surgeon points out that it will be a while before it changes what he does. For the rest of business, even the disrupters are being disrupted, as Netflix and Adobe are finding out. Data protectionism and regulators around the world are driven on by nationalist favouritism mixed with fears of the monopolies of Big Tech. Responses to the fears around AI are just beginning, as are the shifts from Web3 and Edge/SDN.

The trouble with a list of headlines like this is that it causes you to realise all the others that haven’t been included. The past has gone, and the future is a very different place, more different than you realise until you draw it all together.

We are in a Post Everything World

If ever there was a time to do a fundamental, drains-up examination of business models and assumptions, this is it. Two factors stand out as the core principles against which to calibrate readiness:

- Willingness and ability to adjust

- Value generation

The first measures how likely your business will be able to ride the waves of change that lie ahead. The second examines how much of your time and treasure goes into real value building and is worth doing, versus stuff that just makes you busy.

I’ve argued elsewhere about the need for flexibility, and the case for a focus on value generation ought to be self-evident. This blog is aiming to move on from there to highlight some practical ways for business decision makers to get to grips with these urgent challenges and devise strategies to improve their businesses.

Business models – the structure and methodology underlying a business – are an under-utilised opportunity for innovation and competitive advantage. They can also threaten.

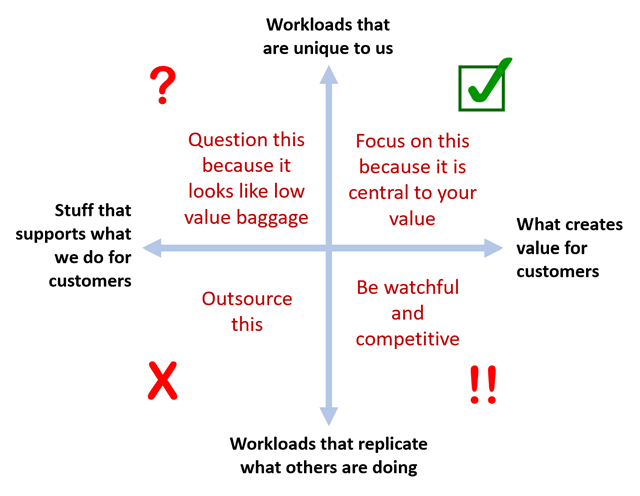

This simple device is a structure to aid analysis of the various areas of cost and effort in your business to challenge assumptions about what is on point and what might not be.

Peter is chairman of Flexiion and has a number of other business interests. (c) 2022, Peter Osborn